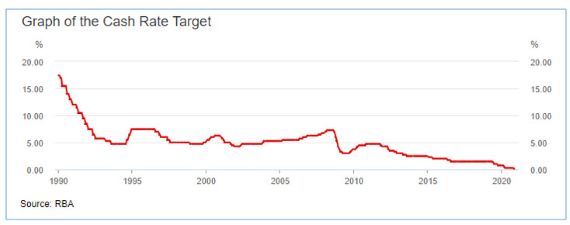

The Reserve Bank’s decision this month to cut the official interest rate to a record low 0.1 per cent was another wake-up call for Australians heavily reliant on income from savings, especially many retirees.

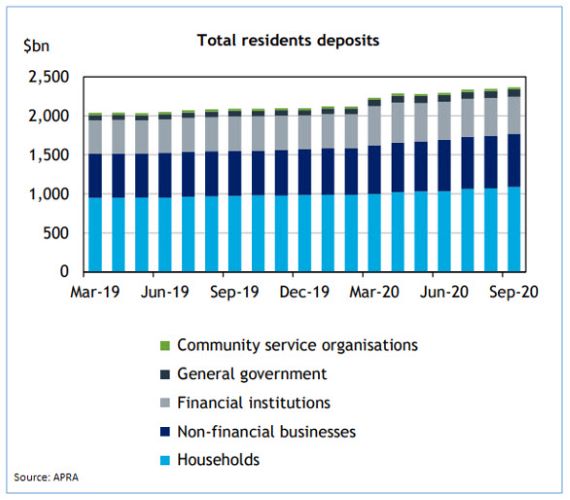

A look at the latest domestic monthly banking statistics shows that at the end of October Australian households collectively had $1.1 trillion deposited in savings account products. Household deposits have been increasing steadily over time.

The four largest banks – ANZ, Commonwealth Bank, NAB and Westpac – hold more than $800 billion of total household cash.

The bulk of these accounts are paying no interest at all, although some products are offering new accountholders promotional bonus rates of around 1 per cent that expire after a few months.

To get a higher savings interest rate one needs to open a term deposit account. Currently it’s possible to lock in a fixed rate of around 1.5 per cent on a three-year term, with four and five-year terms slightly lower at around 1.3 per cent.

However, there are other alternatives to savings accounts and term deposits.

Managed cash funds

Cash is essentially the lowest-risk asset class, and typically suits investors with shorter investment time frames needing quick access to funds.

Investors wanting an income return and a relatively stable capital value also could consider a managed cash fund.

Managed cash funds provide the potential to earn higher returns than bank accounts and term deposits and invest in a range of high-quality, short-term money market investments (that usually mature in 12 months or less).

A key advantage over term deposit accounts is that cash funds provide full liquidity, so funds can be accessed within a few days instead of being locked away for a set period of time.

By investing in a diversified portfolio of securities, cash funds also are less exposed to the performance fluctuations of individual securities.

Managed bond funds

Bonds are securities that can provide a steady and reliable income stream and usually offer a higher interest rate, or yield, than cash.

Total bond returns can include income from interest payments and growth from bond price fluctuations.

When you invest in bonds, you’re effectively lending your money to the bond issuer for a set period of time, in return for interest paid over the term of your investment. Your investment, or capital, is then paid back to you in full at the end of the investment term.

Alternatively, individual bonds can be traded at any time, meaning you can access your capital before a bond’s maturity date.

Bonds can be invested in directly, however a growing number of investors are gaining exposure to bonds through managed bond funds.

Managed bond funds provide a cost-effective way of accessing a diversified portfolio of bonds, which can include a large mix of Australian and international government bonds as well as bonds issued by companies.

Bonds are a low- to medium-risk investment suitable for investors with a timeframe of three years or more.

In addition to providing a regular income stream – an important feature for many investors – bonds may provide a stabilising effect during periods of share market volatility.

Lower for longer

In announcing the latest official interest rate cut, the Reserve Bank said it expects the cash rate to remain at its current level (close to zero per cent) for at least three years.

That, of course, means ultra-low savings and term deposit account returns for an extended period of time.

Households have continued to pay off housing loans and increase balances in offset and redraw accounts at a faster rate than in early 2020, at the same time as lower interest rates have reduced interest payments.

For investors, there are alternatives to savings accounts paying zero per cent interest or term deposit accounts paying low rates that require capital to be locked away for three to five years.

Managed cash funds are also an option in the cash asset class, while managed bond funds are an option in the fixed interest asset class. Both provide broad diversification.

The bigger investment picture

Importantly, all investment options should always be well researched and considered as part of your overall investment goals, risk tolerance and time frame.

A sound investment strategy starts with an asset allocation suitable for your objectives that should be built upon reasonable expectations for risk and returns.

Because all investments involve some degree of risk, managing the balance between risk and potential reward is key.

By Tony Kaye, Senior Personal Finance Writer at Vanguard Australia.

Please contact us on Phone 1300 576 576 if you seek further assistance on this topic.

Source : Vanguard November 2020

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2020 Vanguard Investments Australia Ltd. All rights reserved.

Important: Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.